Assign an individual (an agent) to handle your personal and enterprise responsibilities if you are absent or incapacitated.

A listing of property which you hold during the Trust are topic to the provisions of your Trust. This may be very easily current while you include or take out Trust belongings.

These plans are meant to be used for in-state community colleges/universities. Though You can utilize them to pay for personal colleges or out-of-state universities, you will not get as much bang for your buck. In such a case, you should lose price on your discounts.

We explain the dissimilarities in between two of the commonest forms of life insurance that may help you come to a decision what may be best for you.

For anyone who is like many, you might think that getting life insurance demands a wellness exam. Find out more about an easier path to obtaining life insurance.

His beneficiaries will occur out in advance if he dies involving the 1st day of year 3 (once the ready interval finishes) and the top of yr 6, once the premiums compensated will be about equivalent for the Loss of life reward.

Usually need to undergo probate. Wills commonly must be validated in probate court ahead of the estate’s property could be distributed.

A prepaid tuition program can be a kind of 529 system, never to be bewildered with the financial savings wide variety, that enables account holders to lock in upcoming tuition costs at today’s costs.

Most of the people should have a will, but a living trust might help maintain your assets from going through probate.

If you have wellbeing disorders which are only semi-significant, you would possibly qualify for the graded gain coverage in place of a guaranteed issue plan.

Our associates can not pay out us to ensure favorable evaluations of their merchandise or solutions. Here is a here summary of our partners.

Vehicle insurance guideCompare car insurance ratesBest vehicle insurance companiesCheapest car insurancePolicies and coverageAuto insurance assessments

Should you be scratching your head wondering, “What exactly is life insurance?" Don't be concerned. It is not as difficult mainly because it Appears. Life insurance makes certain that your wife or husband and children — or every other people who rely on your fiscal help — are lined in the case you die prematurely.

Are fixed cash flow cash Safe and sound? The safety of a bond fund is dependent upon the pitfalls of its fundamental holdings. There are 2 Key pitfalls with fixed cash flow investments, credit possibility and interest amount chance. Credit rating risk is the risk that the issuer will not likely pay back the Trader back in a very well timed fashion and curiosity price risk is the danger that the worth of your fixed profits financial commitment will fall if fascination fees rise. A bond fund that primarily invests in very rated investments, like U.S. governing administration securities or financial commitment grade corporate or municipal bonds, would typically be thought of to have lower credit rating chance, but the worth in the fund may still fluctuate as desire fees fluctuate.

Scott Baio Then & Now!

Scott Baio Then & Now! Michelle Pfeiffer Then & Now!

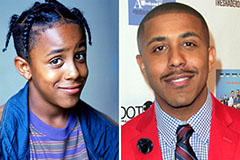

Michelle Pfeiffer Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!